2025 Q3 Newsletter

As we head into fall, we wanted to highlight a couple of items.

First, we want to acknowledge that we cannot do what we do for you without the support of many people, first of whom is Tracy Tychynski. We want to share that she was recognized at the iA Private Wealth Admin Spotlight for her abilities in adopting and using technology as part of our advisory efforts. While she did get quite embarrassed by the attention, we feel lucky to have her as part of our team!

We are also supported by dedicated people in out back office and surrounded by a wonderful group in our office. If you have ever visited us at our office, you know that we share this floor with other advisors and staff. One of the advantages with this arrangement is that we can share knowledge and best practices. We are also supported by iA Private Wealth and iA Financial Group who are committed to our independence, allowing us to act in your best interests without being tied to using specific solutions, whether that be investment choices or financial planning tools. iA PW has just launched a webinar series and we will be including links on our website under the Education tab.

And finally, how fortunate we are to live in Canada.

Our Newsletter will focus on the following topics:

Markets and Interest Rates

Intel

Canadian Roads and Farming

Electricity

Markets and Interest Rates

On September 17, both the Bank of Canada and the U.S. Federal Reserve reduced interest rates by 0.25%. For Canada, this marked the third cut of 2025; for the U.S., the second. The Fed’s target range now sits at 4.0–4.25%.

The two central banks are moving at different speeds because their economies are on different paths. The Economist estimates Canadian growth at 0.9% in 2025, with inflation around 2%. For the U.S., growth is projected at 1.7% with inflation closer to 3%. Like Goldilocks’ porridge, central banks want conditions “just right”: lowering rates when growth is sluggish, raising them when inflation runs too hot.

For investors, these policy shifts add to uncertainty around trade rules. Markets reacted negatively earlier in the year, but company earnings have generally remained resilient. Since May, markets have recovered, though they continue to be sensitive to policy announcements. Looking ahead, we expect a gradual upward trend, punctuated by occasional pullbacks as investors adapt to evolving trade and economic conditions.

Intel

Intel has long been one of the most important companies in the tech world. They’re best known for both designing and manufacturing computer chips, a model that for decades set them apart. While most competitors either focus on design (like Nvidia) or on manufacturing (like TSMC in Taiwan and Samsung in Korea), Intel tried to do both under one roof. That worked for a long time but has become less efficient as competitors scaled up and narrowed their focus. Intel has fallen behind in producing the most advanced chips, raising concerns about its long-term competitiveness.

Recently, both the U.S. government and Nvidia made strategic investments in Intel. The government sees Intel as essential to national security and technological independence, ensuring that cutting-edge chips can be built in the U.S. rather than relying solely on Asia. Nvidia, meanwhile, views Intel as a potential long-term manufacturing partner to secure supply and reduce its reliance on TSMC. While Intel faces real challenges, these moves underline how strategically important it remains to the future of computing and AI.

Source: https://www.economist.com/business/2025/08/21/to-survive-intel-must-break-itself-apart

Canadian Roads and Farming

A common characterization of Canada is that we huddle close to our southern border. And while that may be true for the most of our population, this map interested us from two standpoints, one the extent of the road network on the prairies and how little of BC (and much of Canada) is accessible by road!

As city dwellers we take as given that we can walk into a store and buy our food. Speaking for ourselves, we often take for granted the incredibly hard work farmers do for us. And while we have all noticed prices increasing in the stores, sadly this is not what many farmers are seeing.

An article Jun 30 2025 on the CBC News website highlighted the struggles of BC farmers. High land costs coupled with floods, fires, heat and cold snaps over the last number of years have pushed BC farm incomes seriously negative. BC is also significantly underwater as compared to other provinces, though the report also shows Nova Scotia, Newfoundland and Labrador as having negative income the last few years, but not to the extent of BC’s problems.

Electricity

Another assumption we all make is that we can walk to the wall and flip a switch to turn on the lights, heat our homes or to cook.

The recent fires in Spain and the electrical blackout they experienced highlight an issue we don’t have to think about. Electrical grids must be balanced, the power going in must match the demand going out. The frequency of the current also must be maintained or it will cause the grid to become unstable. Electricity has been traditionally made by spinning massive generators that can quickly adjust to changes in demand and stabilizing the frequency. The heavy weight of these generators provides stabilizing inertia to the grid.

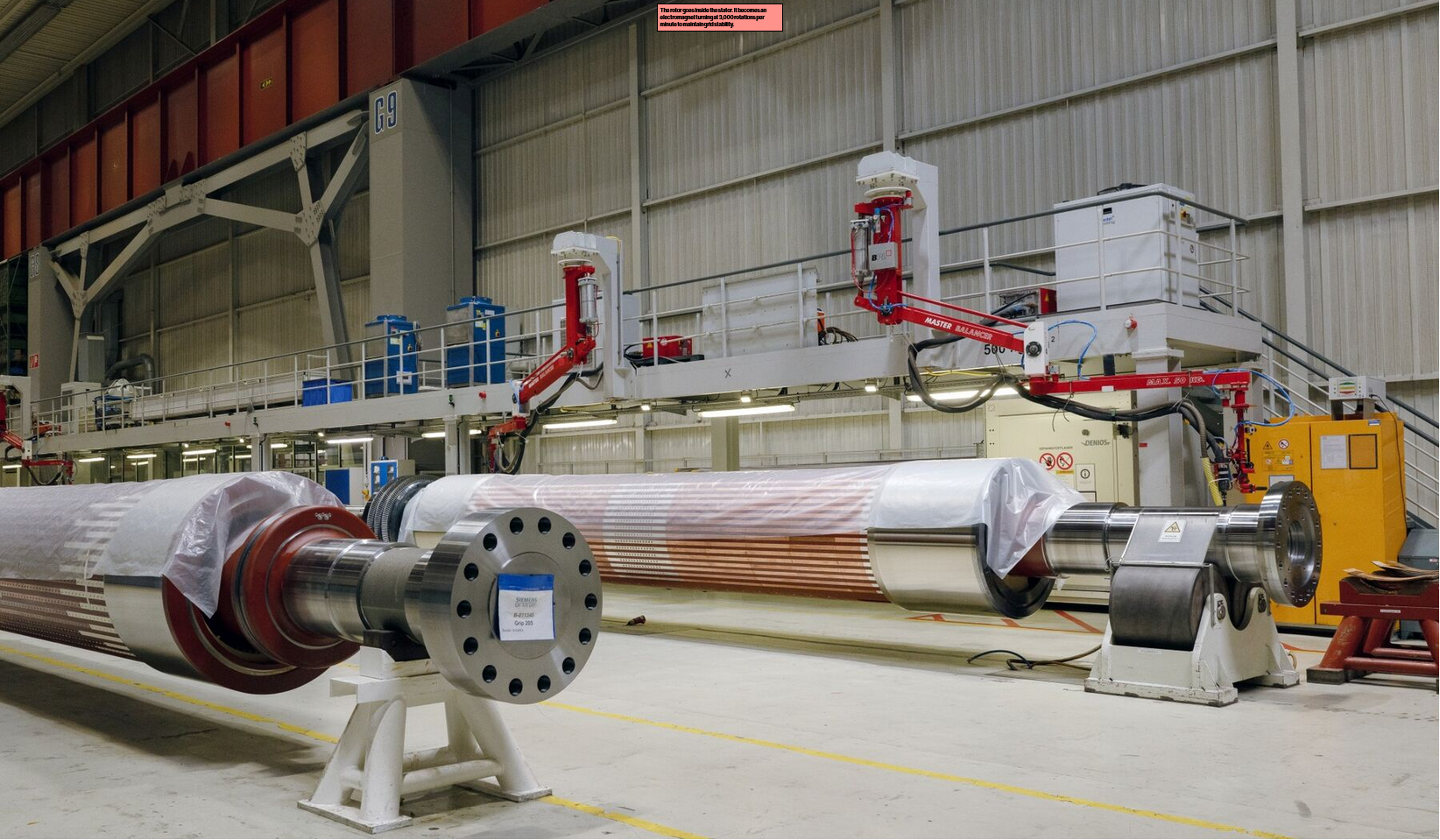

The installation of renewable energy sources have highlighted the need to provide stability into the grid. One solution comes from the Norwegian company Statkraft: synchronous compensators. An electrical motor keeps a hunk of metal constantly spinning at a set number of rotations per minute.

Clever circuitry enables the synchronous compensator to react to grid changes. Statkraft compares the device to adding training wheels on a bicycle, just when it was about to start wobbling and long before it was due to fall.

As renewables such as solar become a bigger component of electricity generation, investment will have to be made upgrading the gird infrastructure. The article suggests that eventually these compensators will be replaced by computerized inverters and battery systems to provide stability into the grid.

Conclusion

In Canada, Thanksgiving falls on the second Monday of October and is a time to reflect on gratitude and the successes of the past year. Originally rooted in harvest celebrations, it’s an opportunity to pause and appreciate the abundance in both our personal and professional lives. Many Canadians mark the day with family, shared meals, and quiet reflection, making it a meaningful moment to recognize achievements and the relationships that matter most.

As always if you have any questions please don’t hesitate to reach out.

Jack Fournier B.Sc, FMA, CIM®

Portfolio Manager | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance Agency

700-609 Granville St. Vancouver, BC

p: 604 895 3348

jack@beaconwealthpartners.ca

Travis Kidson B.Sc, CFP®, CIM®

Portfolio Manager | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance Agency

700-609 Granville St. Vancouver, BC

p: 604 895 3486

travis@beaconwealthpartners.ca

This information has been prepared by Travis Kidson and Jack Fournier who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Managers can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

Insurance products are provided through iA Private Wealth Insurance Agency which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investors Protection Fund.

Beacon Wealth Partners is a personal trade name of Jack Fournier and Travis Kidson.