2025 Q4 Newsletter

As the days get shorter and winter settles in, this time of year always feels like a natural pause. Between the first snowfalls, holiday gatherings, and a bit more time spent indoors, it’s a good opportunity to reflect on the year behind us and think ahead to what’s coming next. In this newsletter, we’ve pulled together a few timely updates and practical thoughts to help you stay grounded and informed as we head into the holidays and start looking toward the year ahead.

Topics for this newsletter include:

US Tariffs impact on Canada vs the World

CRM3

Registered Disability Savings Plan (RDSP)

Update on Canada

Holiday Treats

US Tariffs impact on Canada vs the World

https://www.bankofcanada.ca/publications/mpr/mpr-2025-10-29/section-8/

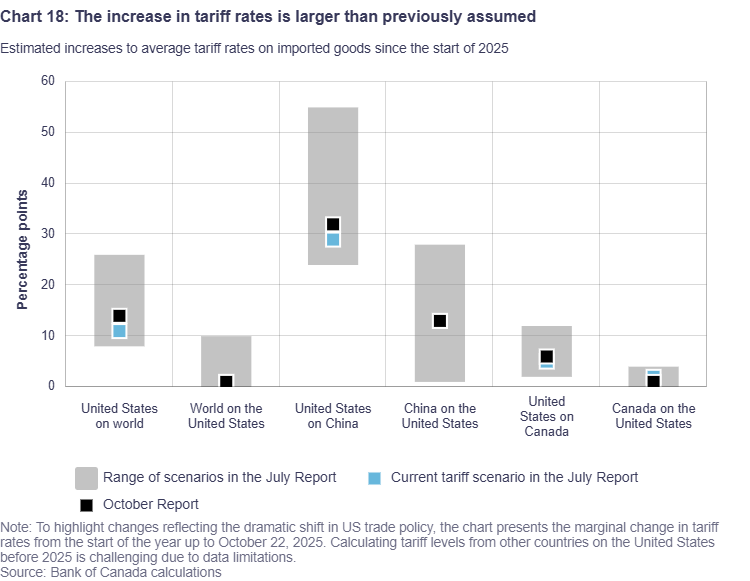

Probably the biggest story of 2025 has been the impact of U.S. tariffs on the global economy. A recent Bank of Canada report from October 2025 gave us some surprising context. It shows that most Canadian exports to the U.S. continue to cross the border duty-free. Roughly 90% of everything we send south faces no tariffs. Despite all the headlines about rising U.S. tariffs, most Canadian exporters haven’t really seen a change in market access under USMCA.

The effects are concentrated in a few specific industries. The average tariff rate on Canadian goods rose from near zero to about 6%, but that increase is almost entirely driven by a handful of products. Steel and aluminum are facing extremely high duties, and vehicles or parts that don’t meet USMCA content rules can see tariffs around 25%. These impacts are meaningful for those sectors, but they don’t reflect the broader export picture.

However, on a global scale US tariffs have had a much stronger impact, particularly with China.

It’s hard to make sense of a global trading system where one country ends up penalizing everyone else, but the U.S. is clearly focused on becoming more self-sufficient. The reality is that the rest of the world including Canada, must adapt. Trade policies are being used more to protect domestic interests, and that’s something businesses and policymakers can’t ignore.

CRM3

Starting in 2026, the Canadian Securities Administrators (CSA) are introducing CRM3, the newest set of reporting rules for clients. The focus this time has been to provide investors a clearer breakdown of the costs and compensation tied to their investments. This will include things like any fees or performance-based compensation an advisor, dealer, or fund company might receive. Think of it as the next step after CRM2 (performance focused), but with a broader look at both costs and the performance of your portfolio.

For our clients, this shouldn’t feel like a big change. We already go through total costs together and focus on the net returns you keep after fees. We also don’t charge bonuses or performance-based fees. The portfolios we build usually include a mix of individual stocks, ETFs, and a few carefully chosen funds that fit your goals. Transparency has always been a priority for us, and CRM3 just adds another layer of clarity to the conversations we’re having.

Registered Disability Savings Plan (RDSP)

We often find the number of account types can be overwhelming, making it hard to determine what options are best for your family. A Registered Disability Savings Plan (RDSP) is a long-term savings tool designed to help Canadians with disabilities and their families prepare for the future. Contributions grow tax-deferred, and the government supports savings through the Canada Disability Savings Grant (CDSG) and the Canada Disability Savings Bond (CDSB). Canadian residents under 60 with a valid Disability Tax Credit (DTC) can open an RDSP, with a lifetime contribution limit of $200,000. While contributions are not tax-deductible, both growth and government contributions accumulate tax deferred.

Government support includes grants of up to 300% on contributions, depending on income, and bonds for low-income Canadians, which can provide up to $1,000 per year even without personal contributions. Withdrawals, known as Disability Assistance Payments (DAPs), are paid only to the plan holder and may be taxable depending on the mix of contributions, grants, and bonds. Overall, the RDSP is a powerful way to build a long-term financial cushion, supplementing other supports like the Canada Pension Plan Disability (CPP-D) and provincial programs.

Most common eligible disabilities:

Autism Spectrum Disorder (ASD)

Intellectual Disabilities / Developmental Delays

Multiple Sclerosis (MS)

Cerebral Palsy

Blindness / Severe Vision Impairment

Heart Conditions

Kidney Disease / Dialysis Dependence

Autoimmune Disorders

Severe Sleep Disorders

Traumatic Brain Injury (TBI)

Parkinson’s Disease

Severe Migraines

Others that are also covered:

Chronic Pain Conditions

Mental Health Disorders

Epilepsy / Seizure Disorders

Hearing Impairment

Diabetes with Complications

Severe Asthma

Severe Anxiety or PTSD

Individuals interested in determining if they would qualify can view eligibility here: https://www.canada.ca/en/revenue-agency/services/tax/individuals/segments/tax-credits-deductions-persons-disabilities/disability-tax-credit/eligible-dtc.html

Update on Canada

The federal budget released in November is projected to lift federal debt to approximately 43% of Canada’s GDP, with debt levels expected to remain elevated over the next five years.

The increase in federal spending is primarily directed toward defense, infrastructure, and housing—sectors that have seen underinvestment for many years and are widely viewed as deserving of renewed focus. Compared with many of its G7 peers, Canada remains in a relatively strong fiscal position, allowing room for higher government spending in the near to medium term. As we have noted previously, meaningful economic gains will also require policy reforms that improve the internal flow of goods and services and reduce barriers to productivity growth.

The Bank of Canada’s policy rate currently stands at 2.25%, following 0.25% reductions in both September and October. The Canadian economy has proven more resilient than initially expected in the face of evolving U.S. tariff policies, with defense spending contributing to recent growth. However, a key area of concern is the emerging weakness in household consumption. The current expectation is that the Bank of Canada will hold interest rates at present levels for the next several months.

Holiday Season Treats

For many, a highlight of Thanksgiving and Christmas is the traditional foods that accompany the season—pumpkin pie, tourtière, Christmas fruitcake, and other richly spiced treats.

Cinnamon, allspice, ginger, cloves, and similar spices give these dishes their distinctive, warming flavours. Today, these ingredients are readily available and affordable, but historically they were rare, highly valuable, and even the cause of conflict. These spices are grown in limited regions of the world and, despite modern trade, remain relatively scarce compared with most everyday food commodities.

We thought it only fitting to include a treat with these fabulous flavours: Recipes

As always, if anything in this newsletter raises questions or you’d like to talk through how it applies to your own situation, feel free to reach out. Wishing you and your family a relaxing holiday season, and all the best as we head into the new year.

Travis Kidson, B.Sc, CFP®, CIM®

Portfolio Manager | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance Agency

700-609 Granville St. Vancouver, BC

p: 604 895 3486

travis@beaconwealthpartners.ca

Jack Fournier B.Sc, FMA, CIM®

Portfolio Manager | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance Agency

700-609 Granville St. Vancouver, BC

p: 604 895 3348

jack@beaconwealthpartners.ca

This information has been prepared by Travis Kidson and Jack Fournier who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Managers can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

Insurance products are provided through iA Private Wealth Insurance Agency which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investors Protection Fund.

Beacon Wealth Partners is a personal trade name of Jack Fournier and Travis Kidson.